Locust control in India

News: Locust control operations (LCOs) carried out in in more than 4 lakh hectares area in 10 states.

Operation details

- Aerial spraying capacity has been strengthened for anti-locust operations.

- A Bell helicopter has been deployed in Rajasthan for use in Scheduled Desert Area as per the need.

- Indian Air Force is also conducting trials in anti-locust operation by using Mi-17 helicopter.

- 5 companies with 15 drones are deployed at Barmer, Jaisalmer, Bikaner, Nagaur and Phalodi in Rajasthan for effective control of locusts on tall trees and in inaccessible areas through spraying of pesticides.

About locust attack in India

- In April this year, Swarms of desert locusts entered in Rajasthan via Pakistan’s Sindh province. Favorable rain-bearing winds aided their transport towards India.

- Desert locusts normally live and breed in semi-arid/desert regions. For laying eggs, they require bare ground, which is rarely found in areas with dense vegetation. Thus, locust is likely to breed in Rajasthan than in the Indo-Gangetic plains.

- Large scale breeding of locust is possible only when conditions turn very favorable (good rain to support vegetation) in their natural habitat, i.e. desert and semi-arid regions.

- Main locust breeding areas in the Horn of Africa, Yemen, Oman, Southern Iran and Pakistan’s Baluchistan and Khyber Pakhtunkhwa provinces have received widespread rains this year.

- The size of these swarms can vary – from less than one square kilometer to several hundred square kilometers. A one square kilometer swarm contains about 40 million locusts and can travel up to 150 km in one day.

- They can eat as much food as 35,000 people assuming that each individual consumes 2.3 kg of food per day.

News details

U.S. Space Command claims of having evidence that Moscow conducted a nondestructive test of a space based antisatellite weapon.

| Chinese and Russian military doctrinesMilitary doctrines of Chinese and Russian militaries indicate that they view space as important to modern warfare and view counterspace capabilities as a means to reduce U.S. and allied military effectiveness. |

U.S. has warned of the “real, serious and increasing” threat against Washington’s systems.

The July 15 event involved “a small space vehicle” that “inspected one of the national satellites from a close distance using special equipment”, as per the U.S. Defense Ministry.

The inspection “provided valuable information about the object that was inspected, which was transmitted to the ground-based control facilities”.

In a space strategy document published recently by pentagon, it asserted China and Russia present the greatest strategic threat due to their development, testing, and deployment of counterspace capabilities and their associated military doctrine for employment in conflict extending to space.

Whereas Russia has insisted its space activities are purely peaceful.

Anti-satellite weapons

- Antisatellite (ASAT) missiles, are designed to destroy satellites without placing the weapon system or any of its components into orbit.

- These systems typically consist of a fixed or mobile launch system, a missile, and a kinetic kill vehicle. These weapons could also be launched from aircraft. Once released, the kinetic kill vehicle uses an onboard seeker to intercept the target satellite.

India’s anti-satellite weapon

- In the beginning of this year, India launched an anti-satellite weapon against a satellite in low Earth orbit in a test known as “Mission Shakti.”

- The weapon was a ground-based missile that hit a satellite at an altitude of about 300 kilometers.

- After this test, India has become the fourth country after the U.S., Russia and China, capable of destroying an enemy satellite

RBI signs $400 mn currency swap facility for Sri Lanka

News: RBI signs documents to extend $400mn currency swap facility to Sri Lanka.

News details

This facility has been extended to boost the Sri Lanka’s draining foreign exchange reserves due to impact of COVID-19 pandemic. Facility will remain available till November 2022.

Additionally, President of Sri Lanka has made a request for a special $1.1 billion currency swap facility.

This announcement came after recent ‘technical discussion’ on rescheduling Colombo’s outstanding debt to India between representative of Sri Lankan government and official of Ministry of External Affairs, Ministry of Finance, and the EXIM Bank.

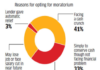

This meeting was a result of Sri Lankan Prime Minister Mahinda Rajapaksa request for a loan moratorium on the loan of $960 million, 5 months ago.

Currency swap facility

Swaps are derivative contracts allow two parties concerned to swap one financial instrument for another at a predetermined time, as specified in the contract. Some of the swaps used regularly are Interest rate swaps, commodity swaps, and currency swaps.

In a currency swap agreement, countries in the agreement will pay for import and export trade in their local currencies on the basis of a pre-determined rates of exchange. It removes the need to use dollar or any other internationally acknowledged currency for the trade between contracting countries.

Special Liquidity Scheme for NBFCs and HFCs

News: A Special Liquidity Scheme of Rs. 30,000 crores for NBFCs and HFCs (Housing Finance Companies) has been implemented under Aatma Nirbhar Bharat package.

About the scheme

The Scheme has been launched to improve the liquidity position of NBFCs/HFCs through a Special Purpose Vehicle (SPV) to avoid any potential systemic risks to the financial sector.

Implemented by: SLS Trust, the SPV set up by SBI Capital Markets Limited (SBICAP).

Eligible organizations:

- Any NBFC including Microfinance Institutions registered with RBI under the Reserve Bank of India Act, 1934 (excluding those registered as Core Investment Companies).

- Any HFC registered with the National Housing Bank (NHB) under the National Housing Bank Act, 1987, complying with certain specified conditions.

The Scheme will remain open for 3 months for making subscriptions by the Trust.

The Scheme permits both primary and secondary market purchases of debt and seeks to address the short-term liquidity issues of NBFCs/HFCs.

Those market participants who are looking to exit their standard investments with a residual maturity of 90 days may also approach the SLS Trust.

Under this scheme, five proposals involving an amount of Rs. 3090 crores have already been sanctioned.

About NBFCs

- NBFC

NBFCs (Non-Banking Financial Company) are registered under the Companies Act, as companies engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business. NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself.

Exclusions: NBFCs do not include any institution whose principal business is that of industrial activity, purchase or sale of any goods (other than securities), or providing any services and sale/purchase/construction of the immovable property, or agriculture activity.

Principal businessRBI introduced the term “principal business” to ensure that only companies predominantly engaged in financial activities get registered as NBFCs. Financial activities will be known as the principal business of NBFCs when:

|

Types of NBFCs:

- NBFCs-D: Accepting Public deposits constitute one of the important sources of funding for these NBFCs.

- NBFCs-ND: NBFCs-ND or Non-Deposit taking NBFCs can be divided into non-deposit taking systemically important NBFCs (NBFCs-ND-SI) and other NBFCs-ND. Their source of funds includes funding from markets and banks. NBFCs with an asset size of ₹500 crores or more are classified as NBFCs-ND-SI.

Assam opposes Centre’s nod to transport pigs to Northeast

News: Assam has opposed the Centre’s recent decision to transport pigs from North India to the Northeast.

News details

- Government has recently allowed movement of pigs from states of Haryana and Punjab to the north-eastern states. And Assam government is opposing this decision of government.

- Notably, the African Swine Fever (ASF) outbreak that Assam and Arunachal Pradesh this year has killed more than 17,000 pigs.

- To contain this disease, Assam government has taken harsh measures to prevent sale of pork, transportation of pigs to ensure that there is no further spread of the disease.

- Any free movement of pigs from outside the state may undermine all steps taken to control the spread.

Background of African Swine Fever disease spread

- ASF is a highly contagious and fatal animal disease that affects wild and domestic pigs typically resulting in an acute hemorrhagic fever.

- The first ASF outbreak was reported in September 2019 in China. The disease hit Assam and Arunachal Pradesh in April this year, resulted in killing of 17,118 pigs in 422 villages in Assam and 4,553 pigs in Arunachal Pradesh.

- It led to ban the slaughter and sale of pigs, and adopt biosecurity measures to contain the spread of the virus in both the states.

Pied cuckoo, harbinger of monsoon, to be tracked in migration

News: First study in India that seeks to trace and observe the migratory routes of the pied cuckoo.

News details

Courtesy – Indian Express

Participants in the study: Wildlife Institute of India (WII), along with the Indian Institute of Remote Sensing (IIRS) and the Government of India’s Department of Biotechnology

It is a study of the migration of the pied cuckoo from Africa to India and back, by tagging two of the birds with satellite transmitters.

This study is a part of larger project known as Indian Bioresource Information Network (IBIN). Aimed to put relevant Indian bioresources information online, IBIN is funded by the Government of India’s Department of Biotechnology (DBT).

Wildlife Institute of India (WII)

Indian Institute of Remote Sensing (IIRS)

|

Under this study, two of the birds have been tagged with satellite transmitters.

Most other migratory species come in winter from colder places like Mongolia, Siberia, northeastern China, Kazakhstan, etc… The pied cuckoo is one of the few species that come to India in the summer. But this has never been ascertained through collected data, which part of Africa they come from.

As per scientists, the arrival of the pied cuckoos (Clamator jacobinus, also called pied crested cuckoo and Jacobin Cuckoo) in the Himalayan foothills has traditionally been seen as heralding the onset of the monsoon.

Importance

Traditionally Farmers have relied on the arrival of the pied cuckoo as a signal of onset of monsoon, to sow seeds. This signal has proved to be very accurate.

Study on Pied Cuckoos will be helpful for information on the monsoon, changes in the monsoon and monsoon winds, erratic rainfall, seasonal fluctuations, water vapor pressure, etc.

Movement patterns of species such as Pied cuckoo any climatic disruption.

Indian Bioresource Information Network (IBIN)

It is a distributed national infrastructure to serve relevant information on diverse range of issues of bioresources of the country.

It is proposed to be uniquely placed as a single portal data provider on India’s bioresource – plant, animal, marine, spatial distribution and microbial resources. This portal will provide platform to the diverse data providers in a mutually sharable environment with full ownership protocols

Funded by: Department of Biotechnology (DBT).